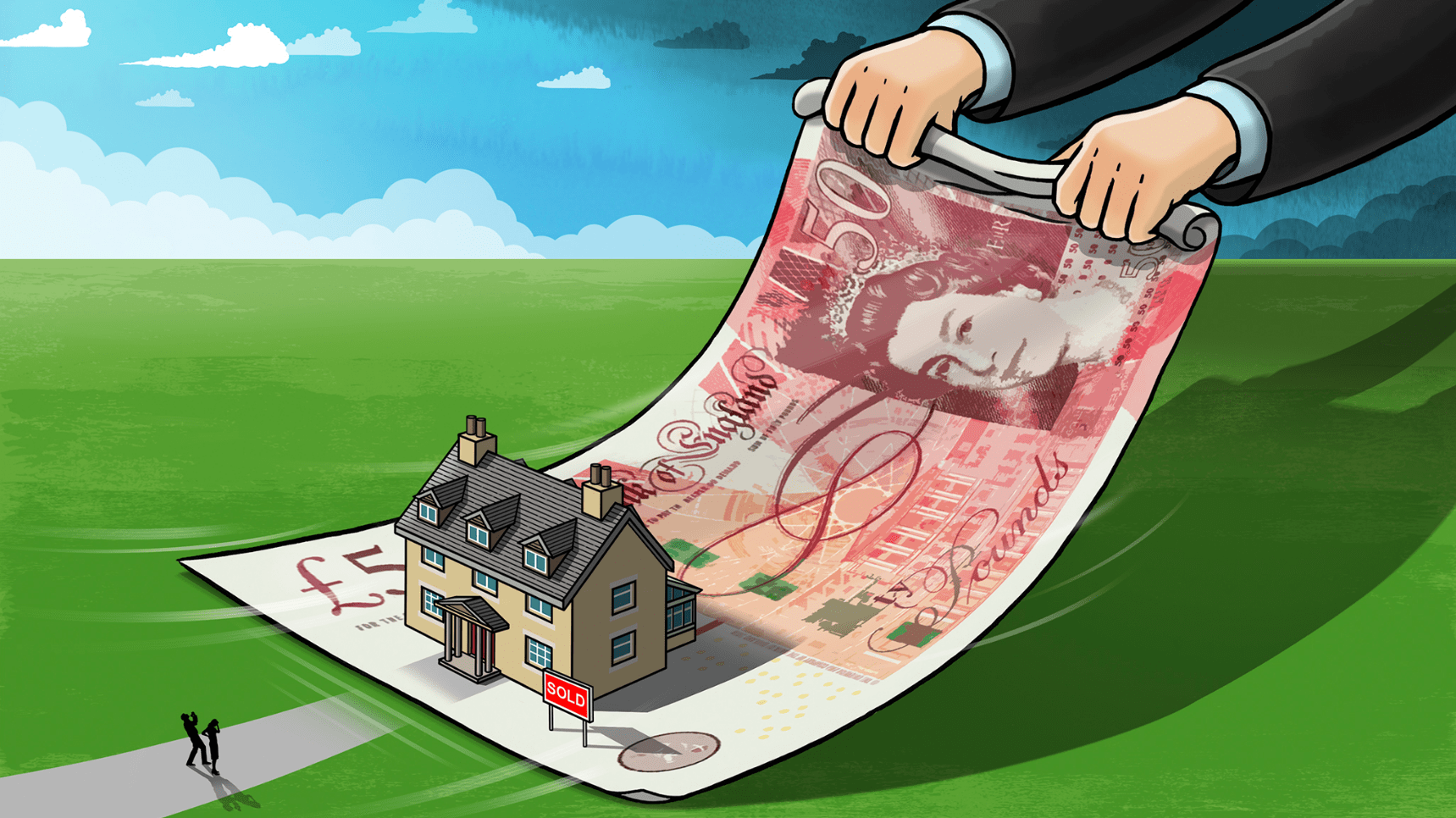

What is gazumping – and how can you avoid it?

Had your offer accepted?

Congratulations, that’s great news!

But before you crack open the bubbly and get carried away picking out furniture for your new living room, there are few perils you need to be aware of.

The most notable of these is that until the keys to the property are firmly in your hand, there’s still a danger you could be gazumped.

What does being ‘gazumped’ mean?

It sounds made up, doesn’t it? Or if not, like it might be kind of fun!?

Well, let us assure you it’s not.

Gazumping is the term used when, despite having had your offer accepted on a property, another buyer moves in to make a higher bid. This results in either you having to raise your initial offer to match or beat the new price, or you falling back to square one with your property search.

Sometimes the new party will be more desirable, for example, they may have no chain and be ready to move now. Meaning that even the temptation of a higher offer won’t sway the seller and you’ll remain gazumped.

Is gazumping allowed?

Upsetting, frustrating, unfair – gazumping is all of these things. But it’s also completely legal in England and Wales.

Although your offer may have been accepted in principle, it does not become legally binding until contracts have been exchanged. Which is why you often see ‘sold – subject to contract’ on property listings.

What’s worse, is that buying and selling property is a lengthy process and the exchange of contracts happens at a relatively late stage. By which time money has often been spent on surveys, property conveyancers, and arranging a mortgage – leaving you seriously out of pocket.

How to avoid being gazumped

Being gazumped is horrible. No one wants the joy of finding the perfect property only to have it snatched away from them.

The good news is, there are things you can do to reduce the likelihood of it happening and to protect yourself…

-

Be ready

The most common reason for gazumping is money. The buyer is swayed by a higher offer. Sometimes though, other factors come into play – such as being able to move quickly and provide a fast sale.

With that in mind anything you can do to be ready for action – selling your current property, having a mortgage and conveyancers in place, etc – will put you in a more favourable light and help to minimise the risk of being gazumped.

-

Get personal

Flattery gets you everywhere – and it could even bag you your new home!

Establishing a connection with the owner makes it less likely that they will leave you in the lurch. And if they can see that you genuinely love their home, not only is there more chance of them wanting you to be the one that buys it, but they will also be encouraged that you mean business and are committed to the sale.

-

Ask for the property to be taken off the market

If a property remains listed, albeit marked ‘sold – subject to contract’, it’s still there for others to see and put in a counteroffer – making the threat of being gazumped very real.

Asking for the property to be taken down is perfectly reasonable. It has a positive effect in 2 ways. Firstly, it shows the buyer you really want it and how serious you are and secondly, it removes the risk of other people making offers.

-

Work with the right team

The faster you can move through the house buying process and exchange contracts the better. So, you need to be confident you have a conveyancer in place who can progress matters swiftly on your behalf, reducing the window of opportunity for anything to go wrong.

Talk to GD Legal Property Solicitors

At GD Legal, our experienced, professional team is 100% committed to taking the stress and strain out of buying property.

What’s more, if you are in the unfortunate position of being gazumped and your sale falls through, we won’t charge you for our services. Now you can’t ask fairer than that can you?

Get your personal quote now or to find out more get in touch.